The farm bill is the primary way for the US government to set agricultural and food policy. The bill is a comprehensive, multiyear piece of legislation that determines programs and policies about food, farms, forestry, fiber and rural issues and provides funding for these diverse areas of the food system. The bill has an enormous affect on farmers, on what and how food is grown, and for both low-income families and rural communities. All of these in turn impact local economies, public health, international trade, the environment, food safety and more.

Policies written into the farm bill can incentivize or restrict certain behaviors. The consequences of these actions, both positive and negative, travel throughout the food system. For example, the farm bill provides federal subsidies for commodity crops – namely corn, soybeans, wheat, rice and sorghum – which are then used as feed for dairy and livestock production or are converted into processed foods and beverage sweeteners. 1 A recent study demonstrated an association between consumption of these subsidized crops, or foods derived from them, with increased risk for metabolic disease. 2 While a number of factors influence what Americans choose to eat, availability and price are certainly critical. 3 Ultimately, the farm bill deploys taxpayer dollars to increase the supply and lower the cost of unhealthy foods, but does relatively little to support healthier foods; fruits and vegetables (termed “specialty crops”) receive less than one-percent the 2018 Farm Bill’s projected $428 billion five-year budget. 4

What Is the Farm Bill?

Passed approximately every five years by the United States Congress, the farm bill is a nearly-$500 billion piece of legislation, or omnibus bill, addressing agriculture and other policy issues under the purview of the US Department of Agriculture (USDA). The bill changes and adjusts parts of existing permanent law; reauthorizes, changes or repeals pieces of previous farm bills; and advances new policies and new programs.

The farm bill is made up of about a dozen sections, called “titles,” covering aspects of the food system from farm to fork. However, the most important basis of the farm bill, since the very first one in 1933, is that it includes two primary issues: 1) farm programs that support farmers growing storable commodity products like corn, soybeans, wheat, rice, cotton and dairy; and 2) federal nutrition programs, including the food stamp program, known today as the Supplemental Nutrition Assistance Program (SNAP). 5

The interplay between these two major sections of the bill is considered key to the passage of the bill in Congress. Members from farming districts work to protect agriculture subsidies, negotiating deals with members from urban districts that support nutrition programs for low-income families in exchange for support of farm programs. Bringing these two constituencies together has historically worked to pass both farm and nutrition programs that likely would not have enough support to pass on their own. When proposals have been made to “split the farm bill” — remove nutrition programs from the bill — there has been strong opposition, recognizing the move would likely lead to deep cuts to the social safety net. 67 Though the farm bill is set to expire every five years, reauthorization is sometimes delayed by the politics of this tenuous alliance.

In the last few decades, the farm bill has grown tremendously. Today, crop insurance and conservation are two significant titles. The bill also covers credit, rural development, agricultural research, horticulture, forestry, local food programs and more.

The laws and programs included in the farm bill are those that fall under the jurisdiction of the House Committee on Agriculture and Senate Committee on Agriculture, Forestry and Nutrition. There are also a host of food and farming issues not included in the farm bill because they are outside the jurisdiction of these committees — including issues having to do with farm and food workers, FDA-controlled food safety programs, agricultural taxation and grazing rights, public lands, laws under the Clean Water Act (administered by the EPA), fisheries, water rights, among others. 8 While child nutrition programs, including school meals, farm to school programs and the Women, Infant and Children Program (WIC), do fall under the purview of the Senate Agriculture Committee, they are addressed in the Child Nutrition Act, which is a separate piece of legislation. Policies related to genetically modified organisms and pesticides are regulated by various agencies including the EPA, FDA and USDA, and are under the jurisdiction of multiple committees, and thus are not included in the farm bill. 9

The Origins of the Farm Bill

The first such bill, the Agriculture Adjustment Act of 1933 was authorized as part of President Franklin Roosevelt’s New Deal, the massive set of domestic programs designed to bring the country out of the Great Depression and make reforms in industry, agriculture, finance, labor, housing and infrastructure. 10 The administration’s aims with the New Deal were to assist the millions of poor and unemployed Americans and to establish both emergency and long term government aid. The bill, which also closely followed the environmental devastation of the Dust Bowl, aimed to keep food prices fair for farmers and consumers, ensure an adequate food supply and protect and sustain the country’s natural resources. 11

The Agricultural Improvement Act of 2018

The most recent farm bill, the Agricultural Improvement Act of 2018, was signed by President Trump in December 2018. The 2018 Farm Bill, as it is commonly called, preserved overall spending levels from the 2014 Farm Bill and, despite measures included in the House version of the bill, did not make cuts to SNAP. 12 In an exciting move for sustainable agriculture advocates, the 2018 farm bill also provided permanent, mandatory – as opposed to discretionary – funding for a number of small but impactful programs, listed within the titles below.

The Twelve Titles of the Farm Bill

TITLE I: COMMODITIES — Covers payment and loan programs for farmers who grow commodity crops like corn, wheat, rice and soybeans. Direct and counter-cyclical payments to farmers have been eliminated; instead, farmers must incur crop losses or damage in order to receive government payments. These programs work together with crop insurance to subsidize the growth of commodity crops. Title One also includes disaster programs for farmers and ranchers, as well as programs offering price supports for sugar and dairy producers. 13

TITLE II: CONSERVATION — Covers conservation programs that provides financial incentives, training and technical assistance to farmers to encourage them to protect waterways, soil, habitats, wild animals and environmentally sensitive lands. It includes programs critical to supporting sustainable agriculture, including the Conservation Reserve Program, the Environmental Quality Incentives Program and the Agricultural Conservation Easement Program, among others. 14

TITLE III: TRADE — Includes programs that focus on providing international food aid to developing countries — a key tool of American diplomacy and foreign policy — and commodity crop exports. It also provides funding for programs that offer technical support to farmers, food education and child nutrition programs across the globe. 15

TITLE IV: NUTRITION — The biggest ticket item in the 2018 bill is the Supplemental Nutrition Assistance Program (SNAP). In addition to offering financial assistance to low-income families to purchase food, this section also includes other related nutrition and education programs, as well as grant programs that the emergency food system relies on to operate food banks and soup kitchens. 16 The biggest hurdle in passing the 2018 Farm Bill was over the issue of cuts to SNAP benefits, specifically limiting work and eligibility requirements for recipients. 17 These cuts were not included in the final version of the bill. The 2018 Farm Bill also includes funding for programs that support local and regional food systems and healthy food access, such as Assistance for Community Food Projects, a local food procurement pilot project, and the Gus Schumacher Nutrition Incentive Program (grants to increase access to fruits and vegetables in low-income communities, formerly the Food Insecurity Nutrition Incentive Program). It also funds critical nutrition programs such as the Healthy Food Financing Initiative and support for the purchase of fresh fruits and vegetables in schools. 1819

TITLE V: CREDIT — Contains programs to extend loans and credit to farmers, including the Consolidated Farm and Rural Development Act, which authorizes USDA credit and rural development programs, loan programs for Native American tribes and tribal corporations, and a grant matching program for states offering last resort loans to farmers unable to obtain money from other lenders. 20

TITLE VI: RURAL DEVELOPMENT — Includes community development and economic and infrastructure development programs, which provide investment and loans for development of cooperatives and small businesses in struggling rural areas, as well as programs intended to combat rural health crises such as substance abuse. 2122 The title also supports rural utilities, water and waste management and other infrastructure. Specific sections offer funding for local food systems through the Rural Microentrepreneur Assistance Program and the Rural Businesses Development Grants program. 23

TITLE VII: RESEARCH AND EXTENSION PROGRAM — Authorizes USDA to conduct agricultural research and provide support for cooperative extension programs and other state-level agricultural higher education programs. The 2018 Farm Bill reauthorized the Organic Agriculture Research and Extension Initiative and the Specialty Crop Research Initiative. 24

TITLE VIII: FORESTRY — Includes programs to protect forests by incentivizing rural communities to be stewards in conservation. 25 After a string of wildfires in California, provisions to actively manage the removal of dead trees and bush became a point of disagreement in the 2018 Farm Bill, as opponents feared it would harm plant and animal life. 26

TITLE IX: ENERGY — Covers the development and promotion of the production of renewable energy from biofuels and agricultural products. It includes grant programs for farmers and rural businesses to incentivize renewable energy and energy efficiency technology installations and improvements, biofuel research and a program that authorizes the Feedstock Flexibility Program, which authorizes the use of Commodity Credit Corporation funds to purchase surplus sugar for resale as biomass feedstock. 27

TITLE X: HORTICULTURE — Includes programs to support fruit and vegetable production (known as “specialty crops”), as well as organic and local foods. The title also includes funding for the innovative programs that small and sustainable farmers and community-based organizations depend on, like the National Organic Certification Cost-Share Program, as well as funding for the Specialty Crop Block Grants. Value-Added Producer Grants and the Farmers Market and Local Food Promotion Programs are now part of this title’s Local Agriculture Market Program, which supports small, local food producers and has been given permanent funding. 28

TITLE XI: CROP INSURANCE — Crop insurance, covered by this title, is now the primary safety net program for farmers. Insurance contracts, which are made on a crop-by-crop and county-by-county basis offer some protection against losses due to market price drops, bad weather or other categories of crop damage. 29

TITLE XII: MISCELLANEOUS — The last title in the 2018 Farm Bill contains a mix of different programs that don’t quite fit into the other titles of the bill. The title is broken into different sections, including livestock, historically undeserved producers, oilheat efficiency, and further miscellaneous provisions. 30 The 2018 Farm Bill came close to tripling the funding for beginning and socially disadvantaged farmers in a program called the Farmer Opportunities Training and Outreach, which will include the Beginning Farmer and Rancher Development Program and the Socially Disadvantaged Farmers and Ranchers Program. 31

Farm Bill Spending

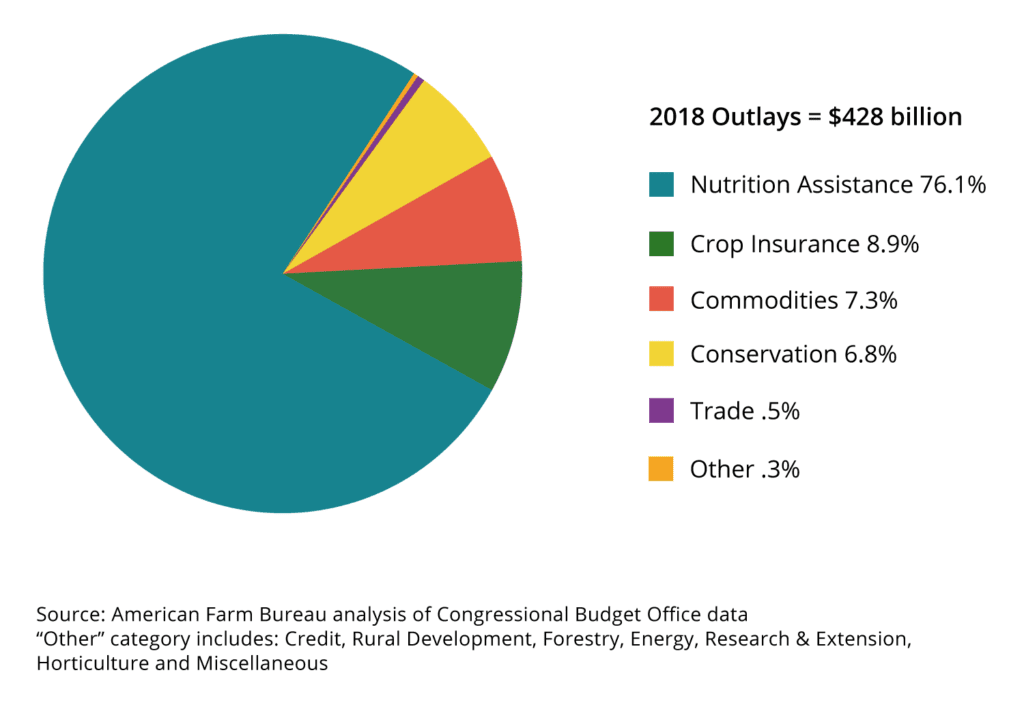

At the time it was signed, the projected five-year cost of the mandatory programs in the 2018 Farm Bill was $428 billion, with much of that cost — about 75 percent — coming from the nutrition title. 32 Based on American Farm Bureau analysis of the Congressional Budget Office’s data, the other big ticket items in the bill include crop insurance subsidies (8.9 percent), conservation programs (6.8 percent) and commodity subsidies (7.3 percent). 33 These costs, however, are based on budget projections, which change with changing economic conditions, program participation rates and other factors. A 2016 recalculation of the cost of the 2014 Farm Bill, for example, put the total cost of the bill at $457 billion instead of the projected $489 billion: a $32 billion dip, resulting largely from a substantial decrease in SNAP costs ($24 billion less) due to lower than anticipated participation in the program thanks to the economic recovery. In addition, a drop in cost levels for crop insurance and conservation programs, coupled with a substantial increase in commodity subsidy costs ($15 billion more) resulting from the poor health of the farm economy in 2016 and 2017, all changed the final cost of the 2014 Farm Bill. 34

Shockingly, only one percent of the cost of the current farm bill actually goes to a combination of fresh produce production, rural communities and sustainable and local agriculture programs. This small piece of the pie includes funding for beginning and minority farmers, value-added programs, rural business development, organic farming, fruits and vegetables, local food, nutrition incentives and agricultural research. 35 Outside of nutrition programs for low income families, on the whole, the farm bill largely supports and incentivizes the production of large-scale monocrops of commodities, dairy and factory farmed meat through its funding and grant programs.

Appropriation vs. Authorization: How Farm Bill Programs Are Funded

In general, there are two types of legislation that Congress works on: authorization bills and appropriation bills. The farm bill is an authorizing legislation, meaning that it creates policies and programs, most of which must then be funded through annual appropriations legislation (government spending bills), which establishes discretionary spending levels for programs to be implemented. There are twelve annual appropriations bills passed by Congress each year. One of these bills is the agriculture appropriations bill, which includes most funding for farm bill programs as well as the US Department of Agriculture (USDA) and Food and Drug Administration (FDA), the agencies which implement those programs. Many farm bill programs are authorized but never appropriated, which means that they never get implemented even though they may exist on paper for years or even decades. Some programs are appropriated but never authorized, although this is rare. 36

Mandatory Programs

The farm bill itself also controls about a half-trillion dollars in funding, referred to interchangeably as mandatory funding or direct funding. 37 The Commodity Credit Corporation — a federal government entity created to support and stabilize farm prices and incomes — provides funding to these mandatory programs as needed (or to the level prescribed in the farm bill), which are not subject to annual funding decisions by Congress. 38 As a result, spending on mandatory programs is not subject to annual limits or variable costs from year to year as a result of changes to the economy or program participation levels; and, there is no automatic reconsideration of funding for these programs over the five-year life of the farm bill. 39 However, funding levels for mandatory programs can be changed, but only by Congress through new legislation. 40 Examples of programs with mandatory funding include SNAP and most commodity and conservation programs. Programs without mandatory funding are vulnerable to being cut in future farm bill iterations. 41

Under regular order, annual agriculture appropriations deal only with discretionary funding. However, in recent years, appropriations bills have also been used by Congress to encroach on the authority of the farm bill and the agriculture committees. 42 By making “changes in mandatory program spending” (or CHIMPS), Congress has been able to reduce mandatory spending on farm bill programs. Significantly for sustainable agriculture, this has been used most often in recent years to reduce the amount of money spent on conservation and renewable energy programs in the farm bill. 43 Also recently, Congress has been adding policy riders (language that makes temporary policy and program changes) to spending bills, to make changes to programs established in the farm bill, like Country of Origin Labeling (COOL) and the Packers and Stockyards Act enforcement (the GIPSA rule, which protects small farmers and ranchers from being unfairly treated by big meat packing corporations). 44

The Making of a Farm Bill

When done in regular order (from drafting the new legislation to putting the programs into effect on the ground), the farm bill process encompasses three main phases: writing and passing the farm bill; funding the farm bill; and rulemaking.

Phase One: Writing and Passing the Farm Bill

Before the current farm bill expires, members of Congress hold hearings in Washington, DC and across the nation to get public input, while stakeholders voice their interests through the media and in meetings with specific senators and representatives. Both the Senate Committee on Agriculture, Nutrition and Forestry and the House Committee on Agriculture then draft and mark up separate bills. Once the committees each agree on their separate proposals they are presented for a full vote in each chamber. If the bill is passed, House and Senate leaders appoint members to a joint conference committee that creates a single new compromise bill that can be passed by both chambers. When the final farm bill is approved it is sent to the President who has the choice to either sign it into law or veto it, forcing Congress to make further changes.

Phase Two: Funding the Farm Bill

After the bill is signed, the legislation then gets funded through the appropriations process discussed above. The first step in the funding process is for the President to send his budget request to Congress. Then, the House and Senate Appropriations Committees send a budget to the Agriculture subcommittee to use to set funding levels for farm bill programs for the coming fiscal year. Once the House and Senate Agriculture Appropriations sub-committees have drafted, finalized and voted on their appropriations bills to fund farm bill programs, the bill is then sent to the larger Appropriations Committees to be “marked up,” or edited. Once the bill is finalized by both the House and Senate Appropriations Committees, the bill goes to a conference committee where the House and Senate bills are combined. It is then sent to the floors of the House and Senate for a final vote and then to the President for signing.

Phase Three: Rulemaking

The final phase of the farm bill process is rulemaking. During this process, programs that have been finalized in the farm bill and funded through the appropriations process are now the responsibility of the USDA, which must figure out how to implement the programs in the bill. At this point, advocates usually meet with USDA staff to discuss the administration of new and existing programs. If a new program has been created under the farm bill, the USDA must put together rules for how to implement the program and make these proposed rules available for public comment through the Federal Register. By law, the comments sent to the USDA are all reviewed by USDA staff, who then incorporates the feedback they receive into the final plan for implementing the program(s). Then, the USDA publishes the finalized rule for how it will implement the program in the Federal Register. The USDA then starts implementing and managing the program according to the newly established rules.

Since the 1980s, funding in the farm bill has been impacted by the budget reconciliation process. Using this process, the agriculture committees cut mandatory spending for programs by the amount directed by the annual congressional budget. 45 The agriculture committee then sends a new bill to the Budget Committee reflecting those program funding cuts by a particular date. 46 The agriculture committee ultimately decides which farm bill programs to cut to reach the target budget number they’ve been assigned. The agriculture committee’s new bill is then combined with other bills reported back from other committees into a large omnibus budget reconciliation bill. This new reconciliation bill, unlike other pieces of legislation, cannot be filibustered in the Senate and can therefore be passed with a majority rather than a supermajority of votes. Budget reconciliation bills were used to cut funding for farm bill programs in 1982, 1987, 1989, 1990, 1993, 1996 and 2005. 47

What You Can Do

- Learn more about the farm bill from the USDA: https://www.rd.usda.gov/files/2014_USDA_Farm_Bill_Highlights.pdf

- Stay up to date on farm bill provisions that affect sustainable agriculture by following the National Sustainable Agriculture Coalition: https://sustainableagriculture.net/take-action/

Hide References

- Siegel, Karen et al. “Association of Higher Consumption of Foods Derived From Subsidized Commodities With Adverse Cardiometabolic Risk Among US Adults.” JAMA Internal Medicine, 176: 3 (August 1, 2016). Retrieved May 31, 2019, from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6512298/pdf/nihms-1019571.pdf

- Ibid.

- Caswell, Julie and Yaktine, Ann, eds. “Supplemental Nutrition Assistance Program: Examining Evidence to Define Benefit Adequacy.” Institution of Medicine, 2013. Retrieved May 31, 2019, from https://www.ncbi.nlm.nih.gov/books/NBK206911/pdf/Bookshelf_NBK206911.pdf

- USDA Economic Research Service. “Projected Spending Under the 2018 Farm Bill.” United States Department of Agriculture, March 11, 2019. Retrieved May 31, 2019, from https://www.ers.usda.gov/topics/farm-economy/farm-commodity-policy/projected-spending-under-the-2014-farm-bill

- National Sustainable Agriculture Coalition. “Farm bill: 2018: A primer.” NSAC, 2016. Retrieved April 12, 2019, from https://www.safsf.org/wp-content/uploads/2016/12/2018-Farm-Bill-Primer-for-SAFSF1.pdf

- Smith, Vincent H. “What happens when you split a farm bill?” American Enterprise Institute, July 11, 2013. Retrieved April 12, 2019, from https://www.aei.org/publication/what-happens-when-you-split-a-farm-bill/

- Weisman, Jonathan and Nixon, Ron. “House Republicans Push Through Farm Bill, Without Food Stamps.” The New York Times, 2013. Retrieved April 12, 2019, from https://www.nytimes.com/2013/07/12/us/politics/house-bill-would-split-farm-and-food-stamp-programs.html

- National Sustainable Agriculture Coalition. “Farm bill: 2018: A primer.” NSAC, 2016. Retrieved April 12, 2019, from https://www.safsf.org/wp-content/uploads/2016/12/2018-Farm-Bill-Primer-for-SAFSF1.pdf

- Ibid.

- Encyclopedia Britannica. “New Deal: United States History.” Encyclopedia Britannica, (n.d.). Retrieved April 12, 2019, from https://www.britannica.com/event/New-Deal

- Dimitri, Carolyn et al. “The 20th Century Transformation of U.S. Agriculture and Farm Policy.” USDA Economic Research Service, Bulletin Number 3. Retrieved April 12, 2019, from https://ageconsearch.umn.edu/bitstream/59390/2/eib3.pdf

- National Sustainable Agriculture Coalition. “2018 Farm Bill by the Numbers.” NSAC, December 21, 2018. Retrieved May 31, 2019, from https://sustainableagriculture.net/blog/2018-farm-bill-by-the-numbers

- Economic Research Service. “Agricultural Act of 2013: Highlights and Implications – Crop Commodity Programs.” USDA, May 1, 2017. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/crop-commodity-programs/

- Economic Research Service. “Agricultural Act of 2013: Highlights and Implications – Conservation.” USDA, February 11, 2019. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/conservation/

- Townsend, Terry. “The 2014 U.S. Farm Bill and Cotton: Proof that the WTO Matters.” Choices, 3rd Quarter 30(2) (2015). Retrieved April 12, 2019, from https://ageconsearch.umn.edu/bitstream/206568/2/cmsarticle_437.pdf

- National Sustainable Agriculture Coalition. “Path to the 2018 Farm Bill: Supplemental Nutrition Assistance Program.” NSAC, March 6, 2017. Retrieved April 12, 2019, from https://sustainableagriculture.net/blog/path-to-the-2018farmbill-nutrition/

- Evich, Helena Bottemiller and Boudreau, Catherine. “The food stamp fight that could kill the farm bill.” Politico, March 28, 2018. Retrieved April 12, 2019, from https://www.politico.com/story/2018/03/28/food-stamp-fight-kill-farm-bill-446477

- Farm Aid. “What’s in the 2018 Farm Bill? The Good, The Bad and the Offal…” Farm Aid, December 20, 2018. Retrieved April 12, 2019, from https://www.farmaid.org/issues/farm-policy/whats-in-the-2018-farm-bill-the-good-the-bad-and-the-offal/

- United States Department of Agriculture, Rural Development. “Farm Bill.” USDA, (n.d.) Retrieved April 12, 2019, from https://www.rd.usda.gov/about-rd/farm-bill

- Wallace, Siobhan. “Credit Programs.” The 2014 Farm Bill, 2014. Retrieved April 12, 2019, from https://www.thefarmbill.com/title-5-credit-programs

- Economic Research Service. “Agricultural Act of 2014: Highlights and Implications – Rural Development.” USDA, October 19, 2016. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/rural-development/

- United States Department of Agriculture. “USDA Prioritizes Investments to Address Opioid Crisis in Rural America (Press Release No. 0075.18).” USDA, April 4, 2018. Retrieved April 12, 2019, from https://www.usda.gov/media/press-releases/2018/04/04/usda-prioritizes-investments-address-opioid-crisis-rural-america

- United States Department of Agriculture, Rural Development. “Farm Bill.” USDA, (n.d.). Retrieved April 12, 2019, from https://www.rd.usda.gov/about-rd/farm-bill

- Economic Research Service. “Agricultural Act of 2014: Highlights and Implications – Research.” USDA, November 29, 2016. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/research/

- National Sustainable Agriculture Coalition. “What is the Farm Bill?” NSAC, (n.d.). Retrieved April 12, 2019, from https://sustainableagriculture.net/our-work/campaigns/fbcampaign/what-is-the-farm-bill/

- McCrimmon, Ryan. “Forestry dispute still slowing farm bill talks.” Politico, November 27, 2018. Retrieved April 12, 2019, from https://www.politico.com/newsletters/morning-agriculture/2018/11/27/forestry-dispute-still-slowing-farm-bill-talks-430445

- Economic Research Service. “Agricultural Act of 2014: Highlights and Implications – Energy.” USDA, April 6, 2017. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/energy/

- National Sustainable Agriculture Coalition. “Release: Farm Bill Delivers Victories for Beginning Farmers, Organic/Local Food.” NSAC, December 11, 2018. Retrieved April 12, 2019, from https://sustainableagriculture.net/blog/final-2018-farm-bill-released/

- Economic Research Service. “Agricultural Act of 2014: Highlights and Implications –Crop Insurance.” USDA, February 11, 2019. Retrieved April 12, 2019, from https://www.ers.usda.gov/agricultural-act-of-2014-highlights-and-implications/crop-insurance/

- House of Representatives. “Agriculture Improvement Act of 2018.” 115th Congress, 2d Session, 2018. Retrieved April 12, 2019, from https://docs.house.gov/billsthisweek/20181210/CRPT-115hrpt1072.pdf

- Paschal, Olivia. “A Boost for Young, Diverse Farmers.” The Atlantic, December 16, 2018. Retrieved April 12, 2019, from https://www.theatlantic.com/politics/archive/2018/12/farm-bill-funds-programs-new-and-diverse-farmers/578260/

- National Sustainable Agriculture Coalition. “Farm bill: 2018: A primer.” NSAC, 2016. Retrieved April 12, 2019, from https://www.safsf.org/wp-content/uploads/2016/12/2018-Farm-Bill-Primer-for-SAFSF1.pdf

- Farm Bureau. “Reviewing the 2018 Farm Bill Baseline.” American Farm Bureau Federation, December 17, 2018. Retrieved April 12, 2019, from https://www.fb.org/market-intel/reviewing-the-2018-farm-bill-baseline

- National Sustainable Agriculture Coalition. “Farm bill: 2018: A primer.” NSAC, 2016. Retrieved April 12, 2019, from https://www.safsf.org/wp-content/uploads/2016/12/2018-Farm-Bill-Primer-for-SAFSF1.pdf

- Ibid.

- Ibid.

- Ibid.

- Economic Research Service. “Projected Spending Under the 2014 Farm Bill.” USDA, March 11, 2019. Retrieved April 12, 2019, from https://www.ers.usda.gov/topics/farm-economy/farm-commodity-policy/projected-spending-under-the-2014-farm-bill/

- Ibid.

- Ibid.

- Monke, Jim. “Farm Bill Programs Without a Budget Baseline Beyond FY2018.” Congressional research Service, May 2, 2018. Retrieved April 12, 2019, from https://fas.org/sgp/crs/misc/R44758.pdf

- National Sustainable Agriculture Coalition. “Farm bill: 2018: A primer.” NSAC, 2016. Retrieved April 12, 2019, from https://www.safsf.org/wp-content/uploads/2016/12/2018-Farm-Bill-Primer-for-SAFSF1.pdf

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- Ibid.